Poll Taxes Effectively Worked Against

A poll revenue enhancement, too known every bit caput revenue enhancement or capitation, is a tax levied equally a stock-still sum on every liable individual (typically every adult), without reference to income or resources.[1]

Head taxes were important sources of revenue for many governments from ancient times until the 19th century. In the United Kingdom, poll taxes were levied by the governments of John of Gaunt in the 14th century, Charles 2 in the 17th and Margaret Thatcher in the 20th century. In the United States, voting poll taxes (whose payment was a precondition to voting in an election) have been used to disenfranchise impoverished and minority voters (specially under Reconstruction).[2]

By their very nature, poll taxes are considered that less full general financial pressure on the population and very regressive. Many other economists brand them as highly harmful taxes for low incomes (100 monetary units of a fortune of x,000 represent 1% of said wealth, while 100 monetary units of a fortune of 500 represents twenty%) Its credence or "neutrality" (there is no truly neutral tax on the population) will depend on the corporeality of payment that is agreed upon and set by the government body. Therefore, low amounts generally become unnoticed simply as loftier amounts generate many tax revolts.

Examples of such tax riots are the 1381 Peasants' Revolt in England and the 1906 Bambatha Rebellion confronting colonial rule in South Africa.[iii] [4]

The word "poll" is an archaic term for "head" or "top of the head". The sense of "counting heads" is found in phrases like polling place and opinion poll.[five]

Religious law [edit]

Mosaic Constabulary [edit]

Equally prescribed in Exodus, Jewish law imposed a poll tax of a half-shekel, payable by every man above the age of twenty.

Exodus thirty:xi-xvi:[6]

11 And the LORD spake unto Moses, saying,

12 When k takest the sum of the children of Israel later on their number, then shall they give every man a bribe for his soul unto the LORD, when thou numberest them; that there be no plague among them, when thou numberest them.

xiii This they shall requite, every one that passeth amongst them that are numbered, half a shekel after the shekel of the sanctuary: (a shekel is xx gerahs:) an half shekel shall be the offering of the LORD.

14 Every one that passeth among them that are numbered, from xx years old and above, shall give an offering unto the LORD.

15 The rich shall not give more, and the poor shall non give less than one-half a shekel, when they give an offering unto the LORD, to make an atonement for your souls.

16 And thou shalt take the atonement money of the children of Israel, and shalt appoint it for the service of the tabernacle of the congregation; that it may be a memorial unto the children of State of israel before the LORD, to brand an atonement for your souls.

The money was designated for the Tabernacle in the Exodus narrative and later for the upkeep of the Temple of Jerusalem. Priests, women, slaves and minors were exempted, although they could offer information technology voluntarily. Payment by Samaritans or Gentiles was rejected. It was collected yearly during the month of Adar, both at the Temple and at special collection bureaux in the provinces.

Islamic law [edit]

Zakat al-Fitr is an obligatory charity that must exist given past every Muslim (or their guardian) about the cease of every Ramadan. Muslims in dire poverty are exempt from it.[7] The amount is 2 kg of wheat or barley, or its greenbacks equivalent. Zakat al-Fitr is to be given to the poor.[8]

Jizya was either imposed as a country tax or a poll tax imposed under Islamic law on non-Muslims permanently residing in a Muslim state as part of their dhimmi status. Every bit a poll taxation, the tax usually only practical to free, abled-bodied adult men. The jizya could also be qualified past the income of the individual. Various rationales take been posited for the poll-taxation. A common one is that it is a fee in exchange for being able to practise one's religion under an Islamic land, or being a fee in exchange for Muslim protection from outside aggregation. Some interpreters saw it as evidence of the humiliated condition of religious minorities. For instance, Amr ibn al-As, after conquering Arab republic of egypt, set up a census to measure the population for the jizya, and thus the total expected jizya revenue for the whole province, merely organized the actual collection by sectionalisation the population into wealth classes, and so that the rich paid more and the poor less jizya of that total sum. Elsewhere, it is reported customary to partition into iii classes, e.g. 48 dirhams for the rich, 24 for middle class and 12 for the poor.[9] In 1855, the Ottoman Empire abolished the jizya tax, every bit part of reforms to equalize the status of Muslims and non-Muslims. It was replaced past a military machine-exemption tax on non-Muslims, the Bedel-i Askeri.

Information technology was once thought that the Islamic poll-tax was related to a Byzantine poll-tax in pre-Islamic times, but all such sources for the Byzantine poll-tax have now been redated to the Islamic flow, leaving no Byzantine evidence for this do in pre-Islamic times.[10]

Canada [edit]

The Chinese head tax was a fixed fee charged to each Chinese person entering Canada. The caput tax was outset levied later on the Canadian parliament passed the Chinese Clearing Act of 1885 and was meant to discourage Chinese people from inbound Canada after the completion of the Canadian Pacific Railway. The tax was abolished past the Chinese Clearing Human activity of 1923, which stopped all Chinese immigration except for business concern people, clergy, educators, students, and other categories.[eleven] The 1923 deed was revoked in 1947.[12]

Ceylon [edit]

In Ceylon, a poll tax was levied past the British colonial authorities of Ceylon in 1920. The tax charged two rupees per yr per male adult. Those who did not pay had to work on the roads for i day in lieu of the revenue enhancement. The Young Lanka League protested the tax, led past A. Ekanayake Gunasinha, and it was repealed past the Legislative Quango of Ceylon in 1925 following a motility submitted by C. H. Z. Fernando.[13]

Great Uk [edit]

The poll revenue enhancement was essentially a lay subsidy, a tax on the movable property of almost of the population, to assist fund state of war. It had outset been levied in 1275 and connected under different names until the 17th century. People were taxed a percentage of the assessed value of their movable goods. That percent varied from year to year and identify to place, and which goods could exist taxed differed betwixt urban and rural locations. Churchmen were exempt, as were the poor, workers in the Royal Mint, inhabitants of the Cinque Ports, tin workers in Cornwall and Devon, and those who lived in the Palatinate counties of Cheshire and Durham.

14th century [edit]

The Hilary Parliament, held betwixt January and March 1377, levied a poll tax in 1377 to finance the war confronting French republic at the request of John of Gaunt who, since Rex Edward III was mortally sick, was the de facto head of authorities at the time. This revenue enhancement covered about sixty% of the population, far more than lay subsidies had earlier. Information technology was levied two more times, in 1379 and 1381. Each time the taxation basis was slightly different. In 1377, every lay person over the age of 14 years who was not a beggar had to pay a groat (4d) to the Crown. Past 1379 that had been graded by social form, with the lower age limit changed to sixteen, and to 15 ii years afterwards. The levy of 1381 operated under a combination of both flat rate and graduated assessments. The minimum amount payable was fix at 4d, even so tax collectors had to account for a 12d a head hateful assessment. Payments were therefore variable; the poorest would theoretically pay the everyman rate, with the deficit being met by a college payment from those able to afford it.[xiv] The 1381 tax has been credited as one of the principal reasons behind the Peasants' Revolt in that yr, due in part to attempts to restore feudal conditions in rural areas.

17th century [edit]

The poll tax was resurrected during the 17th century, usually related to a military emergency. Information technology was imposed by Charles I in 1641 to finance the raising of the army against the Scottish and Irish uprisings. With the Restoration of Charles 2 in 1660, the Convention Parliament of 1660 instituted a poll taxation to finance the disbanding of the New Model Ground forces (pay deficit, etc.) (12 Charles II c.9).[15] The poll tax was assessed co-ordinate to "rank", e.1000. dukes paid £100, earls £threescore, knights £20, esquires £10. Eldest sons paid 2/3rds of their father'south rank, widows paid a third of their late husband'southward rank. The members of the livery companies paid according to company's rank (eastward.g. masters of beginning-tier guilds similar the Mercers paid £10, whereas masters of fifth-tier guilds, similar the Clerks, paid five shillings). Professionals as well paid differing rates, e.g. physicians (£x), judges (£xx), advocates (£5), attorneys (£3), and so on. Anyone with property (land, etc.) paid 40 shillings per £100 earned, anyone over the historic period of sixteen and unmarried paid twelvepence and everyone else over 16 paid sixpence.

To finance the Ix Years' War, a poll tax was imposed over again by William III and Mary 2 in 1689 (1 Will. & Mar. c.13), reassessed in 1690 adjusting rank for fortune, and then once again in 1691 back to rank irrespective of fortune. The poll tax was imposed again in 1692, and one last fourth dimension in 1698 (the last poll tax in England until the 20th century).

A poll taxation ("polemoney") was simultaneously imposed in Scotland by the Edinburgh parliament in 1693, once more in 1695, and two in 1698.

As the greater weight of the 17th century poll taxes fell primarily upon the wealthy and powerful, it was not besides unpopular. In that location were grumblings within the taxed ranks about lack of differentiation by income within ranks. Ultimately, it was the inefficiency of their drove (what they brought in routinely roughshod far short of expected revenues) that prompted the government to abandon the poll tax after 1698.

Far more controversial was the hearth tax introduced in 1662 (xiii & 14 Charles Ii c.10), which imposed a hefty two shillings on every hearth in a family unit dwelling, which was easier to count than persons. Heavier, more than permanent and more than regressive than the poll tax proper, the intrusive entry of tax inspectors into individual homes to count hearths was a very sore point, and it was promptly repealed with the Glorious Revolution in 1689. Information technology was replaced with a "window tax" in 1695 since inspectors could count windows from outside homes.

20th century [edit]

The Community Charge, popularly dubbed the "poll tax", was a tax to fund local regime, instituted in 1989 by the government of Margaret Thatcher. It replaced the rates that were based on the notional rental value of a house. The abolition of rates was in the Bourgeois Party manifesto for the 1979 full general election; the replacement was proposed in the Greenish Paper of 1986, Paying for Local Government based on ideas developed by Dr. Madsen Pirie and Douglas Mason of the Adam Smith Institute.[16] It was a stock-still revenue enhancement per adult resident, just there was a reduction for those with lower household income. Each person was to pay for the services provided in their customs. This proposal was contained in the Conservative Party manifesto for the 1987 general election. The new tax replaced the rates in Scotland from the beginning of the 1989/90 fiscal year and in England and Wales from the get-go of the 1990/91 fiscal year.[17]

The organization was very unpopular since many thought it shifted the tax burden from the rich to the poor, as it was based on the number of occupants living in a house, rather than on the estimated market value of the house. Many tax rates gear up by local councils proved to exist much higher than earlier predictions since the councils realised that not they but the central regime would be blamed for the tax, which led to resentment, even amidst some who had supported the introduction of it.[eighteen] The tax in different boroughs differed considering local taxes paid past businesses varied and grants past primal government to local authorities sometimes varied capriciously.

Mass protests were chosen past the All Britain Anti-Poll Taxation Federation with which the vast majority of local Anti-Poll Tax Unions (APTUs) were affiliated. In Scotland, the APTUs called for mass nonpayment, which rapidly gathered widespread support and spread as far equally England and Wales even though no-payment meant that people could be prosecuted. In some areas, 30% of former ratepayers defaulted. While owner-occupiers were easy to tax, nonpayers who regularly inverse accommodation were about impossible to trace. The cost of collecting the tax rose steeply, and its returns vicious. Unrest grew and resulted in a number of poll taxation riots. The most serious was in a protest at Trafalgar Square, London, on 31 March 1990, of more 200,000 protesters. Terry Fields, Labour MP for Liverpool Broadgreen, was jailed for 60 days for his refusal to pay the poll tax.[19] [20]

This unrest was a factor in the fall of Thatcher. Her successor, John Major, replaced the Community Accuse with the Council Tax, similar to the rating system that preceded the Community Charge.[21] The main differences were that it was levied on capital value rather than notional rental value of a property, and that it had a 25% discount for unmarried-occupancy dwellings.[22]

In 2015, Lord Waldegrave reflected in his memoirs that the Community Accuse was all his own work and that it was a serious mistake. Although he felt the policy looked like it would work, it was implemented differently from his predictions "They went gung-ho and introduced information technology overnight in i go, which was never my plan and I thought they must know what they were doing - merely they didn't."[23]

French republic [edit]

In France, a poll tax, the capitation of 1695, was first imposed past King Louis XIV in 1695 equally a temporary measure out to finance the War of the League of Augsburg, and thus repealed in 1699. It was resumed during the State of war of Spanish Succession and in 1704 set on a permanent basis, remaining until the end of the Ancien regime.

Like the English poll tax, the French capitation tax was assessed on rank – for taxation persons, French society was divided in twenty-two "classes", with the Dauphin (a form past himself) paying 2,000 livres, princes of the blood paying 1500 livres, and and then on downwards to the lowest class, equanimous of day laborers and servants, who paid 1 livre each. The bulk of the common population was covered by four classes, paying forty, xxx, x and 3 livres respectively. Unlike almost other direct French taxes, nobles and clergy were not exempted from capitation taxes. It did, even so, exempt the mendicant orders and the poor who contributed less than 40 sous.

The French clergy managed to temporarily escape capitation assessment by promising to pay a total sum of four million livres per annum in 1695, and and then obtained permanent exemption in 1709 with a lump sum payment of 24 million livres. The Pays d'états (Brittany, Burgundy, etc.) and many towns also escaped assessment by promising annual fixed payments. The nobles did non escape cess, merely they obtained the correct to appoint their own capitation taxation assessors, which immune them to escape most of the brunt (in one calculation, they escaped vii⁄8 of it).

Compounding the burden, the assessment on the capitation did non remain stable. The pays de taille personelle (basically, pays d'élection, the bulk of France and Aquitaine) secured the ability to assess the capitation tax proportionally to the taille – which effectively meant adjusting the burden heavily against the lower classes. According to the estimates of Jacques Necker in 1788, the capitation tax was so riddled in practice, that the privileged classes (nobles and clergy and towns) were largely exempt, while the lower classes were heavily crushed: the lowest peasant course, originally assessed to pay 3 livres, were at present paying 24, the second lowest, assessed at x livres, were now paying 60 and the third-lowest assessed at 30 were paying 180. The total drove from the capitation, co-ordinate to Necker in 1788, was 41 meg livres, well short of the 54 million gauge, and it was projected that the revenues could accept doubled if the exemptions were revoked and the original 1695 cess properly restored.

The one-time capitation tax was repealed with the French Revolution and replaced, on thirteen Jan 1791,[24] with a new poll revenue enhancement equally part of the contribution personnelle mobilière, which lasted well into the late 19th century. It was fixed for every individual at "three days'southward labor" (assessed locally, but by statute, no less than i franc 50 centimes and no more than than 4 francs 50 centimes, depending on the area). A habitation revenue enhancement (impôt sur les portes et fenêtres, similar to the English window-tax) was imposed in 1798.

New Zealand [edit]

New Zealand imposed a poll tax on Chinese immigrants during the 19th and early 20th centuries as office of their broader efforts to reduce the number of Chinese immigrants.[25] The poll tax was effectively lifted in the 1930s following the invasion of Mainland china past Nippon, and was finally repealed in 1944. Prime Minister Helen Clark offered New Zealand'due south Chinese customs an official amends for the poll tax on 12 Feb 2002.[26] [27]

Poland–Lithuania [edit]

The Jewish poll tax was a poll tax imposed on the Jews in Polish–Lithuanian Republic. It was later absorbed into the hiberna tax.[28] [29]

Roman Empire [edit]

The ancient Romans imposed a tributum capitis (poll tax) as one of the principal direct taxes on the peoples of the Roman provinces (Digest l, tit.xv). In the Republican menses, poll taxes were principally nerveless by private tax farmers (publicani), but from the time of Emperor Augustus, the collections were gradually transferred to magistrates and the senates of provincial cities. The Roman census was conducted periodically in the provinces to depict up and update the poll tax annals.

The Roman poll taxation fell principally on Roman subjects in the provinces, simply not on Roman citizens. Towns in the provinces who possessed the Jus Italicum (enjoying the "privileges of Italy") were exempted from the poll tax. The 212 edict of Emperor Caracalla (which formally conferred Roman citizenship on all residents of Roman provinces) did not, however, exempt them from the poll tax.

The Roman poll tax was deeply resented—Tertullian bewailed the poll revenue enhancement equally a "badge of slavery"—and information technology provoked numerous revolts in the provinces. Peradventure almost famous is the Zealot revolt in Judaea of 66 Advertising. After the destruction of the temple in 70 Advert, the Emperor Vespasian imposed an extra poll tax on Jews throughout the empire, the fiscus judaicus, of two denarii each.

The Italian defection of the 720s, organized and led by Pope Gregory Two, was originally provoked by the attempt of the Constantinople Emperor Leo III the Isaurian to introduce a poll tax in the Italian provinces of the Byzantine Empire in 722, and set in motion the permanent separation of Italy from the Byzantine empire. When Rex Aistulf of the Lombards availed himself of the Italian dissent and invaded the Exarchate of Ravenna in 751, one of his first acts was to plant a burdensome poll tax of one gold solidus per head on every Roman citizen. Seeking relief from this burden, Pope Stephen II appealed to Pepin the Short of the Franks for aid; this action led to the establishment of the Papal States in 756.

Russia [edit]

The Russian Empire imposed a poll tax in 1718.[30] Nikolay Bunge, Finance Government minister from 1881 to 1886 under Emperor Alexander III, abolished information technology in 1886.[31]

United States [edit]

Poll revenue enhancement [edit]

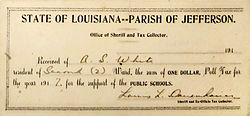

Prior to the mid 20th century, a poll taxation was implemented in some U.S. state and local jurisdictions and paying it was a requirement before one could practice one's right to vote. After this correct was extended to all races by the Fifteenth Amendment to the Constitution, many Southern states enacted poll taxes as a means of excluding African-American voters, most of whom were poor and unable to pay a tax. So as non to disenfranchise many whites, such laws sometimes included a clause exempting whatsoever people who had voted prior to enactment of the laws.[32] The poll tax, along with literacy tests and actress-legal intimidation,[33] achieved the desired effect of disenfranchising African Americans. Often in United states discussions, the term poll tax is used to mean a taxation that must be paid in order to vote, rather than a capitation tax only. (For instance, a bill that passed the Florida House of Representatives in April 2019 has been compared to a poll tax because it requires one-time felons to pay all "financial obligations" related to their sentence, including court fines, fees, and judgments, before their voting rights volition be restored every bit required past a referendum that passed with 64% of the vote in 2018.[34] [35]) The Twenty-fourth Amendment, ratified in 1964, prohibits both Congress and the states from conditioning the right to vote on payment of a poll revenue enhancement or any other type of tax.

Capitation and federal taxation [edit]

The ninth section of Article One of the Constitution places several limits on Congress'south powers. Amid them: "No capitation, or other direct, tax shall be laid, unless in proportion to the census or enumeration herein earlier directed to be taken". Capitation here means a tax of a uniform, fixed corporeality per taxpayer.[36] Direct tax ways a taxation levied directly past the The states federal authorities on taxpayers, every bit opposed to a revenue enhancement on events or transactions.[37] The United States government levied direct taxes from time to fourth dimension during the 18th and early 19th centuries. Information technology levied straight taxes on the owners of houses, land, slaves and estates in the late 1790s only cancelled the taxes in 1802.[ citation needed ]

An income tax is neither a poll tax nor a capitation, as the amount of tax will vary from person to person, depending on each person's income. Until a Us Supreme Court determination in 1895, all income taxes were deemed to be excises (i.due east., indirect taxes). The Revenue Deed of 1861 established the first income tax in the United States, to pay for the price of the American Civil War. This income tax was abolished after the state of war, in 1872. Some other income tax statute in 1894 was overturned in Pollock v. Farmers' Loan & Trust Co. in 1895, where the Supreme Court held that income taxes on income from belongings, such as rent income, interest income, and dividend income (withal excepting income taxes on income from "occupations and labor" if only for the reason of not having been challenged in the case, "We have considered the human activity only in respect of the tax on income derived from real manor, and from invested personal property") were to be treated as direct taxes. Because the statute in question had not apportioned income taxes on income from property by population, the statute was ruled unconstitutional. Finally, ratification of the Sixteenth Subpoena to the United States Constitution in 1913 made possible modernistic income taxes, by limiting the Sixteenth Subpoena income tax to the class of indirect excises (i.eastward. excises, duties, and imposts) – thus requiring no circulation,[38] [39] a practise that would remain unchanged into the 21st century.

Employment-based head taxes [edit]

Various cities, including Chicago and Denver, have levied head taxes with a set charge per unit per employee targeted at large employers.[twoscore] [41] After Cupertino postponed head tax proposals to 2020, Mountain View became the only city in Silicon Valley, California, to go along to pursue such type of taxes.[42]

In 2018, the Seattle city council proposed a "head taxation" of $500 per year per employee.[43] [44] [45] The proposed tax was lowered to $275 per year per employee, was passed, and became "the biggest caput tax in U.S. history,"[46] though information technology was repealed less than a month later.

See likewise [edit]

- Corvée

- Fixed tax

- Hut tax

- Constrained equal losses - a similar rule in the context of bankruptcy problems.

References [edit]

- ^ "poll tax". Oxford Globe Encyclopedia. Philip'southward. 2004. ISBN9780199546091.

- ^ Franklin, John Hope (1961). Reconstruction After the Civil War. U. of Chicago Printing. pp. 127–151. OCLC 5845934.

- ^ "Peasants' Revolt". The National Archives . Retrieved 7 November 2021.

- ^ Hennop, Jan (9 June 2006). "SA to mark historic Zulu rebellion". Contained Online. Archived from the original on 12 July 2006.

- ^ Moon, Nick (1999). Opinion Polls: History, Theory and Exercise. Manchester University Press. p. 2. ISBN0-7190-4224-0.

- ^ "Exodus 30:xi-16, Authorized Version".

- ^ Keskin, Tugrul, ed. (2012). The Folklore of Islam: Secularism, Economy and Politics. Ithaca Press. p. 449. ISBN978-0-86372-425-1.

- ^ Yvonne Yazbeck Haddad, Jane I. Smith (2014). The Oxford Handbook of American Islam. p. 166.

- ^ Hassan, Abul; Choudhury, M. A. (2019). Islamic Economics: Theory and Practise. London: Routledge. p. 247. ISBN978-1-138-36241-3.

- ^ Roger Bagnall, Egypt in the Byzantine World, 300-700, Cambridge 2007, pg. 445.

- ^ James Morton. "In the Sea of Sterile Mountains: The Chinese in British Columbia". Vancouver, BC: J.J. Douglas, 1974.

- ^ Ng, Wing Chung (1999). The Chinese in Vancouver, 1945-80: The Pursuit of Identity and Ability. UBC Press. pp. 120–121. ISBN978-0-7748-0733-three.

- ^ Ekanayake Goonesinha, Kesera. "A. Due east. Goonesinha - May Twenty-four hour period hero and Father of the Trade Union Movement". Daily News. Retrieved 6 August 2020.

- ^ Encounter Fenwick, Carolyn Christine (1983). The English Poll Taxes of 1377, 1379 and 1381: A Critical Examination of the Returns (PhD thesis). London School of Economic science and Political Science (University of London).

- ^ Statutes of the Realm, vol. v, p.207-225

- ^ Pearce, Ed (19 Apr 1993). "The prophet of individual profit". The Guardian.

- ^ Collins, Nick (ix March 2011). "Local government funding timeline: From rates to poll tax to quango tax". The Daily Telegraph. Archived from the original on 12 Jan 2022.

- ^ Smith, Peter (December 1991). "Lessons From the British Poll Revenue enhancement Disaster" (PDF). National Tax Journal. 44 (4): 421–436. doi:ten.1086/NTJ41788932. S2CID 42053969. Archived from the original (PDF) on 14 October 2019.

- ^ Chaplain, Chloe (22 October 2018). "The biggest protests in recent history... and the affect they had". inews.co.britain. Archived from the original on 14 Oct 2019. Retrieved xiv October 2019.

- ^ Wheal, Chris (14 April 1999). "Poll tax is history". The Guardian.

- ^ Higham, Nick (30 December 2016). "Thatcher's Community Charge miscalculation". BBC News.

- ^ Waterhouse, Rosie (thirteen September 1992). "Uproar predicted over council tax". The Independent. Archived from the original on xiv October 2019. Retrieved 14 October 2019.

- ^ "Poll tax a mistake, says Waldegrave". BBC News. 20 July 2015.

- ^ Jones, Colin (2014). The Longman Companion to the French Revolution. Routledge. p. 15. ISBN978-1-317-87080-7.

- ^ "The Poll Revenue enhancement on Chinese in New Zealand: what'south information technology all nearly? | Events | National Library of New Zealand". natlib.govt.nz. Archived from the original on 28 July 2020. Retrieved 20 November 2020.

- ^ New Zealand Role of Ethnic Affairs (2002). "Chinese Poll Tax in New Zealand – Formal Apology". New Zealand Department of Internal Affairs. Retrieved eighteen Baronial 2006. [ permanent dead link ]

- ^ "Address to Chinese New Year celebrations". The Beehive . Retrieved 26 August 2021.

- ^ Scepter of Judah: The Jewish Autonomy in the Eighteenth-Century Crown Poland, pp. 15-16

- ^ The Cambridge Dictionary of Judaism and Jewish Culture, p. 118 (browse for "skhumot" online)

- ^ Vidal-Naquet, Pierre, ed. (1987). The Collins Atlas of Globe History. Great Britain: William Collins Sons & Co Ltd. p. 178. ISBN978-0-00-217776-four.

- ^ Holland, Andy (2010). Russian federation and its rulers 1855–1964. Access to History. U.k.: Hodder Education. p. 126. ISBN978-0-340-98370-6.

- ^ "Guinn & Beal v. United States, 238 U.S. 347 (1915)". Justia.

- ^ "Civil Rights Motion -- Literacy Tests & Voter Applications". Archived from the original on 16 November 2015. Retrieved nineteen October 2014.

- ^ Guess, Monique (25 Apr 2019). "Is This the New Poll Tax? Florida House Passes Bill Requiring Quondam Felons to Pay Up Before They Can Vote". The Root . Retrieved 25 April 2019.

- ^ Mak, Tim (vii Nov 2018). "Over ane Million Florida Felons Win Right To Vote With Amendment iv". NPR.org . Retrieved 25 April 2019.

- ^ United states Department of State (2004). "The Constitution of the U.s.a. of America with Explanatory Notes". Us Section of State web site. United States. Archived from the original on 14 May 2008. Retrieved xviii May 2008.

- ^ Us Department of the Treasury. "History of the U.S. Taxation System". Us Treasury Department : Instruction : Fact Sheets : Taxes. United States. Archived from the original on 27 November 2010. Retrieved 4 August 2009.

- ^ "BRUSHABER v. UNION PACIFIC R. CO., 240 U.Southward. 1 (1916)". FindLaw : Supreme Court. FindLaw.

- ^ "STANTON 5. BALTIC MINING CO, 240 U.South. 103 (1916)". FindLaw : Supreme Court. FindLaw.

- ^ "Seattle head tax: How 2 other large cities fared". Male monarch v. ix May 2018. Retrieved 12 June 2018.

- ^ "Seattle backs new taxation on largest companies, including Amazon". CNBC. Reuters. fifteen May 2018. Retrieved 15 May 2018.

The head tax approved on Monday is not the first. Denver has enacted a similar tax, and Chicago had one just repealed information technology. Seattle itself had a head tax in effect from 2006 to 2009

- ^ KHALIDA SARWARI (1 August 2018). "Cupertino shelves proposed 'caput tax' on Apple employees for now". The Mercury News . Retrieved ii August 2018.

The council's 4-0 decision to wait until 2020 before putting the tax proposal before voters leaves Mountain View every bit the merely Silicon Valley city proceeding with the and so-called head tax this twelvemonth.

- ^ Jessica Lee (10 May 2018). "How did we get here? A await back on Seattle'south head-tax programme and Amazon's response". Seattle Times . Retrieved 11 May 2018.

The Seattle Times has reported on the so-called "caput tax" proposal

- ^ "Seattle head tax 101: What to know about the proposal". MyNorthwest . Retrieved eleven May 2018.

The Seattle had taxation proposal is an employee hours tax

- ^ "NEW SEATTLE HEAD TAX PROPOSAL SETS UP POTENTIAL Clash IN Council Meeting TODAY". King five. 11 May 2018. Retrieved xi May 2018.

A new proposal to Seattle City Council's controversial head tax legislation could bring a compromise

- ^ Chris Daniels; Natalie Brand (14 May 2018). "Seattle Mayor Durkan vows to sign head revenue enhancement compromise". KGW . Retrieved 15 May 2018.

The head revenue enhancement is the largest in U.Due south. history

External links [edit]

![]()

Look up caput tax in Wiktionary, the free dictionary.

- Chisholm, Hugh, ed. (1911). . Encyclopædia Britannica. Vol. 22 (11th ed.). Cambridge University Press. pp. 6–7.

- Middle Ages Poll Tax

- Pictures by Paul Ross, who witnessed the riots

- The battle that brought down Thatcher – a perspective by the Trotskyist Militant group

Poll Taxes Effectively Worked Against,

Source: https://en.wikipedia.org/wiki/Poll_tax

Posted by: hoffmanacese1963.blogspot.com

0 Response to "Poll Taxes Effectively Worked Against"

Post a Comment